change in net working capital as a percentage of change in sales

Net Working Capital Formula Current Assets Current Liabilities. Secondly the coming years sales forecast is taken as a base and the component is calculated per the percentage.

Change In Net Working Capital Nwc Formula And Calculator

The NWC relative to sales varies by industry as net working capital can represent 2 of sales or even 20 of sales.

. Therefore working capital will decrease. For instance if a companys current liabilities are 1890000 its current assets are 2450000 and its total assets equal 3550000 the company can find its net working ratio like this. The formula is working capital divided by gross sales times 100 For example if working capital amounts to 140000 and gross sales are 950000 working capital as a percentage of sales is 1474 percent.

You just need to minus the current years working capital from last years. And Change in Net Working Capital is an integral part to arrive at the value of Free Cash Flow which is used in valuation and financial modelling. Working capital as a percent of sales is calculated by dividing working capital by sales.

For working capital add the accounts receivable 8333 and inventory 12500 then subtract accounts payable 1042. Consider two companies both having the same working capital of USD 100. Working Capital to Sales.

You can use the following formula for calculating NWC ratio. To calculate net sales subtract returns 400 from gross sales 25400. Net sales 25000 Working capital 19791 The quarter 1.

Compare the ratio against other companies in the same industry for additional insights. The formula is working capital divided by gross sales times 100 For example if working capital amounts to 140000 and gross sales are 950000 working capital as a percentage of sales is 1474 percent. Annualized net sales Accounts receivable Inventory - Accounts payable Management should be cognizant of the problems that can arise if it attempts to alter the outcome of this ratio.

Plus as revenues rise or fall net working capital tends to stay constant as a percentage of sales. The sales to working capital ratio is calculated by dividing annualized net sales by average working capital. Now changes in net working capital are 3000 10000 Less 7000.

It means Company A would have to find ways to fund this increase. Net working capital is defined as current assets minus current liabilities. For accounts payable are 20 million and sales are 100 million accounts payable as a percentage of sales would be 20.

But if sales fall a scenario I worry about as a lender NWC may or may not shrink and free up cash to meet loan obligations. If no other expenses are incurred working capital will increase by 20000. Net working capital ratio is found by dividing current assets by current liabilities.

Calculate working capital as a percentage of sales using gross sales revenue figures from the profit-and-loss or income statement. You can express the ratio as a percent that tells you what percentage of net working capital you have out of all incoming cash flow. In this example the change in working capital in 2021 comes to be negative -24046000000.

Companies may over stock or under stock because of expectations of shortage of raw materials. And Change in Net Working Capital is an integral part to arrive at the value of Free Cash Flow which is used in valuation and financial modelling. It may sell shares take on more debt or sell assets to meet the increase in the working capital.

In general the higher the number the more financial risk is involved in company operations as it takes a higher degree of assets to run short-term operations. This means that for a company with positive net working capital NWC will grow as sales grow and be a use of cash. In-depth Explanation of Working Capital.

Formula Working Capital to Sales Ratio Working Capital Sales Meaning Stating the working capital as an absolute figure makes little sense. First each component of working capital as a percentage of sales is calculated. In this case the change is positive or the current working capital is more than the last year.

Net Working Capital Ratio Current assets Current Liabilities Heres a couple examples. November 13 2021 A change in working capital is the difference in the net working capital amount from one accounting period to the next. A business has current assets totaling 150000 and current liabilities totaling 100000.

If a company sells merchandise for 50000 that was in inventory at a cost of 30000 the companys current assets will increase by 20000. As mentioned above and you might know Net Working Capital enables analysts and investors to gauge where a company is positioning. If no other expenses are incurred working capital will increase by 20000.

If a business requires a lot of current assets to generate sales and those assets are funded by cash then the net working capital as. The formula is working capital divided by gross sales times. The formula is working capital divided by gross sales times 100 For example if working capital amounts to 140000 and gross sales are 950000 working capital as a percentage of sales is 1474 percent.

Likewise calculate for the rest of the years. The last step is to find the change in net working capital. Working capital as a percent of sales is calculated by dividing working capital by sales.

A management goal is to reduce any upward changes in working capital thereby minimizing the need to acquire additional funding. A Take WC as a of sales each year then use the delta of those two numbers for your FCF impact.

Changes In Net Working Capital All You Need To Know

Change In Working Capital Video Tutorial W Excel Download

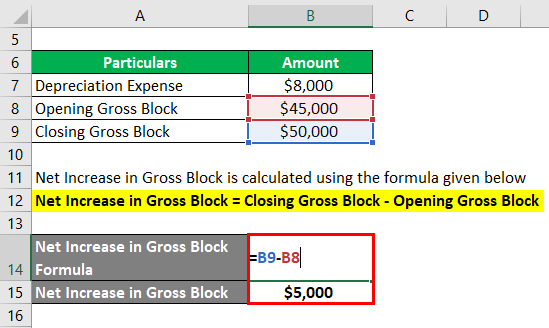

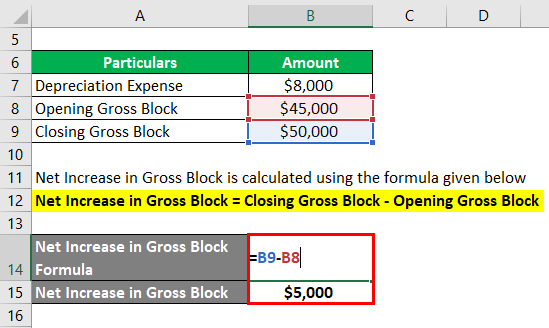

Capital Investment Formula How To Calculate Capital Investment

Interim Financial Statement Template Unique Interim Financial Statements Example Lux Statement Template Mission Statement Template Personal Financial Statement

Change In Working Capital Video Tutorial W Excel Download

Change In Net Working Capital Nwc Formula And Calculator

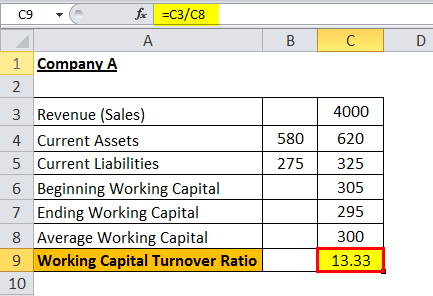

Working Capital Turnover Ratio Meaning Formula Calculation

What Is Net Working Capital How To Calculate Nwc Formula

Net Working Capital Formula Calculator Excel Template

Change In Working Capital Video Tutorial W Excel Download

Change In Net Working Capital Nwc Formula And Calculator

Common Financial Accounting Ratios Formulas Financial Analysis Accounting Small Business Resources

/workingcapital.asp-Final-7145e98d92d446938fa2123de0f36220.png)

/workingcapital.asp-Final-7145e98d92d446938fa2123de0f36220.png)