refinance transfer taxes new york

View Top-Rated Refinance Companies. Pickup or payoff fee.

Edge Fintrack Capital Online Sip Calculator In India Interest Calculator Make Friends Online Investing

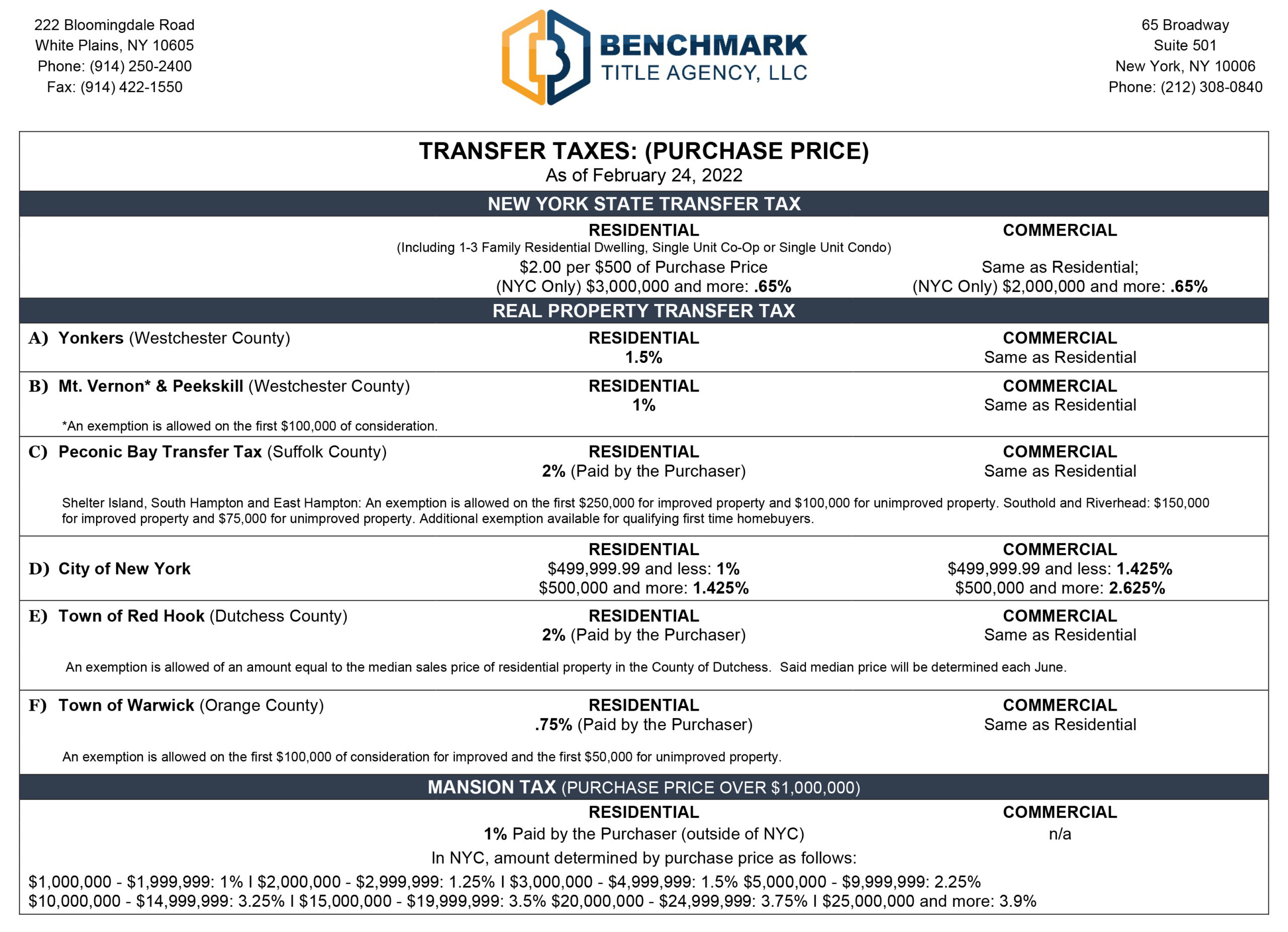

The following tax rates apply.

. See How Much You Can Save. New York State. For example Colorado has a transfer tax rate of 001 while people.

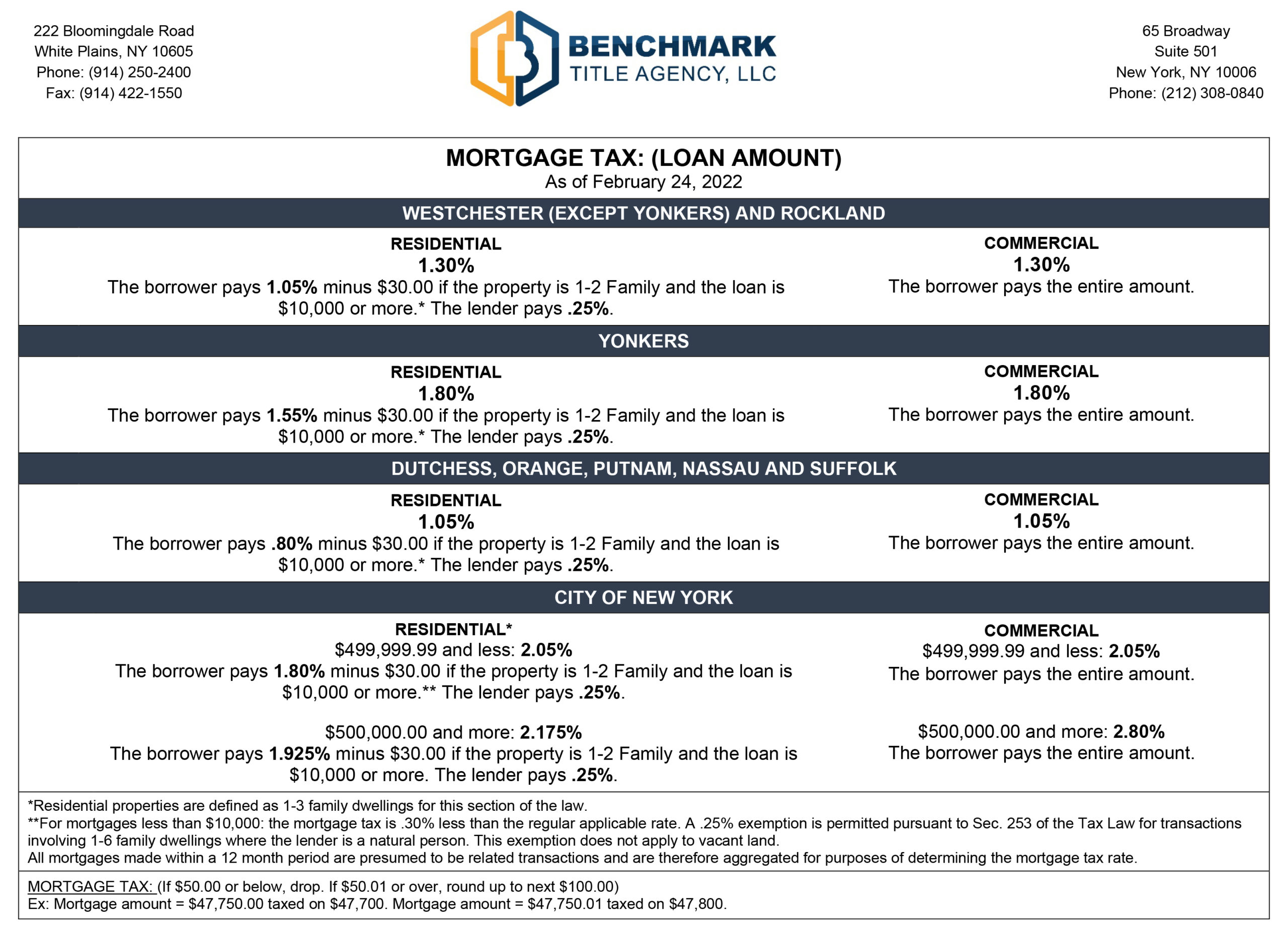

What are refinance transfer taxes. Recorded Mortgage on Full Refinanced Amount. The rate is highest in New York City where borrowers pay 18 percent of the loan.

The tax is usually paid as part of closing costs at the sale or transfer of property. The New York State Real Estate Transfer Tax RETT is imposed on real property conveyances at a rate of 2 per 500 of consideration. 50000 x 18 900.

The NYC Real Property Transfer Tax is a seller closing cost of 14 to 2075 which applies to the sale of real property valued above 25000 in New York City. In a nut shell for residential condominiums and 1-3 family homes when the mortgage is less than 500000 the borrowers portion of the. The MRT is the largest.

If a person is being added to the property deed at the time of refinancing then the person will have to pay the transfer taxes. Heres how it works. The rate varies by county with the minimum being 105 percent of the loan amount.

In New York State. Transfer tax differs across the US. In addition New York City Yonkers and various counties impose local taxes on mortgages that are recorded in those jurisdictions.

What is the real estate transfer tax rate in New York. 395 053 shipping 053 shipping 053 shipping. Average closing costs in New York.

Thats 1528750 in savings. Refinance transfer taxes new york Saturday. STATE OF NEW YORK STOCK TRANSFER TAX STAMPS 10 AND 20 PAIRS MNH-OG.

In a refinance transaction where property is not. Saving New York State Mortgage Recording Tax Gonchar Real Estate Refinancing Your House How A Cema Mortgage Can Help. In New York State the transfer tax is calculated at a rate of two dollars for every 500.

If the mortgage was then assigned for 1 million the buyer. The lender will contribute 25 of the mortgage tax. For homes with sales prices over 500000 the tax is 1425.

If you buy a home in that price range the average closing. The New York City transfer tax sits at 1 of the sales price for homes worth 500000 or less. New York 2000.

Seller 100 positive Seller 100 positive. Yes the CEMA process allows you to only pay the mortgage tax on the new money. Say an initial mortgage was for 1 million and the seller paid it down over the time to 900000.

50000 x 18 900. Rather than the Seller paying transfer tax on the full sale price the transfer tax is the sale price less the amount of the. Do you have to pay NYS mortgage tax on a.

The New York City Mortgage Recording Tax MRT rate is 18 for loans lower than 500000 and 1925 for loans of 500000 or. 18th May 2010 0533 am. Across the state the average home sale price is between 400000 and 500000.

April 17 2020. Compare Refinance Rates Apply. If the value of the property is 499999 or.

Ad Compare Lowest Mortgage Refinance Rates Today For 2022. Generally transfer taxes are paid when property is transferred between two parties and a deed is recorded. The tax must be paid again when.

13th Sep 2010 0328 am. The tax rate and amount of tax due depends on the type of sale or transfer of property. The NYC Mortgage Recording Tax MRT is 18 for loans below 500k and 1925 for loans of 500k or more.

By PropertyClub Team. In resales the New York City real estate transfer tax formally known as the Real Property Transfer Tax RPTT is paid by the seller. Residential Type 1 and.

Ad Start Your Refinance Online With Americas 1 Online Lender. 13th Sep 2010 0328 am. North Carolina 1000.

Lender Pays Part of the Mortgage Recording Tax. Real estate transfer taxes are considered part of the closing costs in a home sale and are due at the closing.

Nyc Transfer Tax What It Is And Who Pays It Streeteasy

Mortgage Tax Transfer Tax Benchmark Title Agency Llc

Nyc Nys Transfer Tax Calculator For Sellers Hauseit

Clep Credit Undergraduate Admissions Admissions Undergraduate College Prep

Saving New York State Mortgage Recording Tax Gonchar Real Estate

Reducing Refinancing Expenses The New York Times

Online Legal Advice From Expert Lawyers In India Vakilpro Advokat Finansy Septik

Real Estate Transfer Taxes In New York Smartasset

10 Reasons To Move To Delaware Home Buying Tips Delaware Moving

Nyc Nys Seller Transfer Tax Of 1 4 To 2 075 Hauseit

A Comprehensive Guide To The Nys And Nyc Transfer Tax Yoreevo Yoreevo

Here Are A Few Resources For Bookkeeping Tax Questions From Wayfare Accounting Llc Tax Questions Resources Scholarships

Mortgage Tax Transfer Tax Benchmark Title Agency Llc

Here Are A Few Resources For Bookkeeping Tax Questions From Wayfare Accounting Llc Tax Questions Resources Scholarships

Nyc Nys Seller Transfer Tax Of 1 4 To 2 075 Hauseit